Novel financing for a historic city plagued by flooding: the Hampton Environmental Impact Bond

By Jason Lee, Associate Director, Environmental Finance

Rendering Credit: Waggonner&Ball

Enhanced outcome measurement moves the Hampton Environmental Impact Bond a step beyond green bonds, and will benefit the City’s future resilience projects

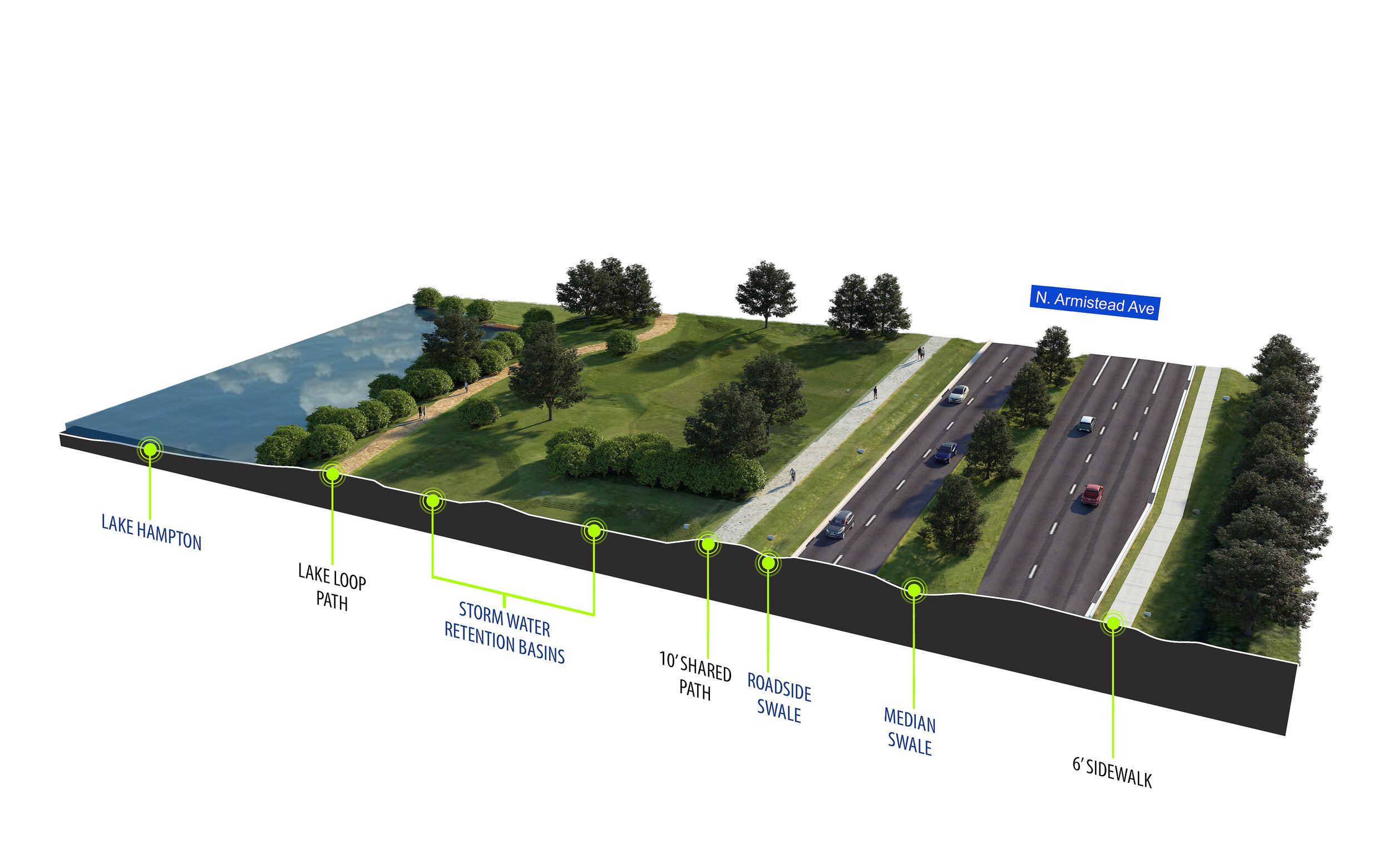

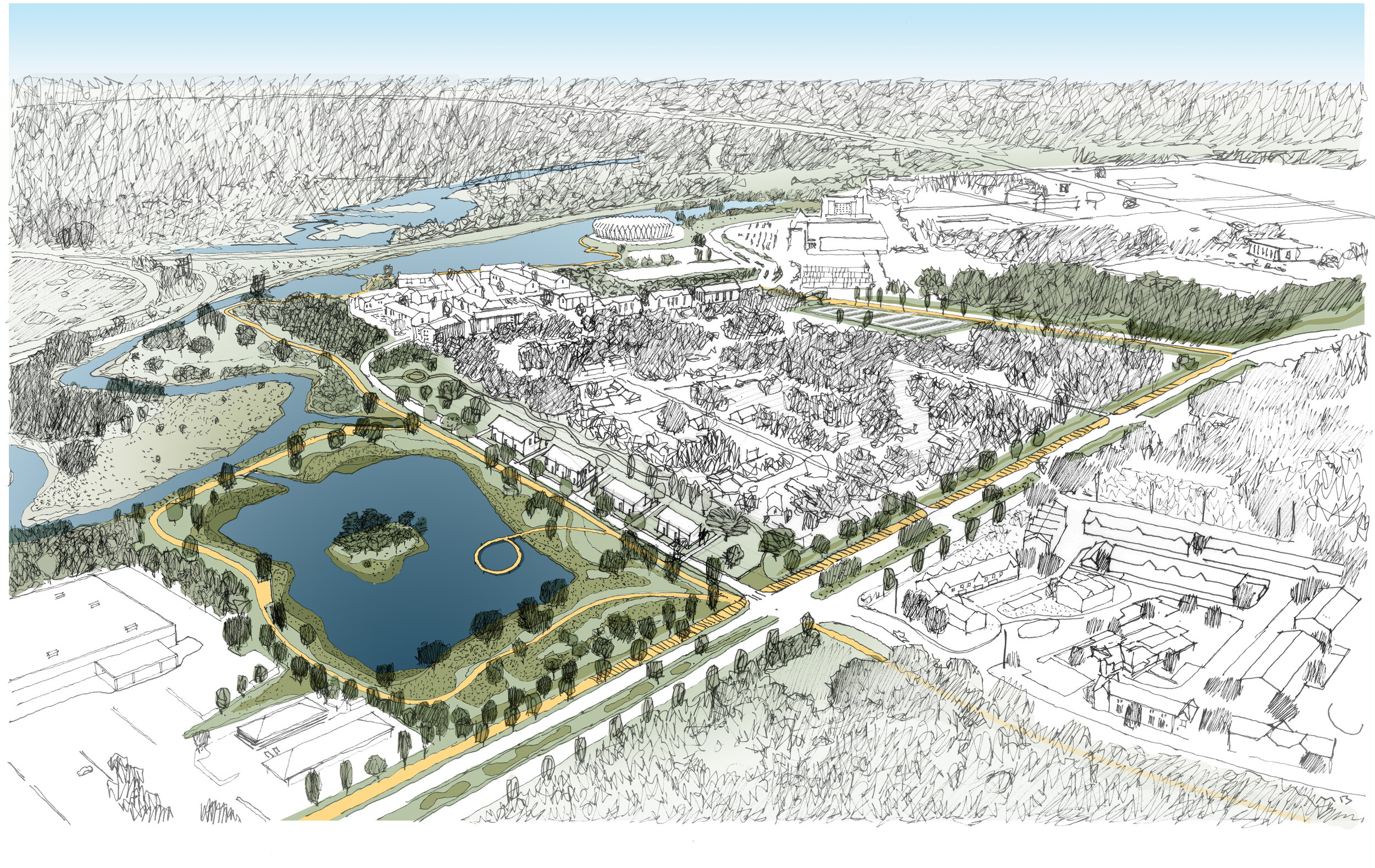

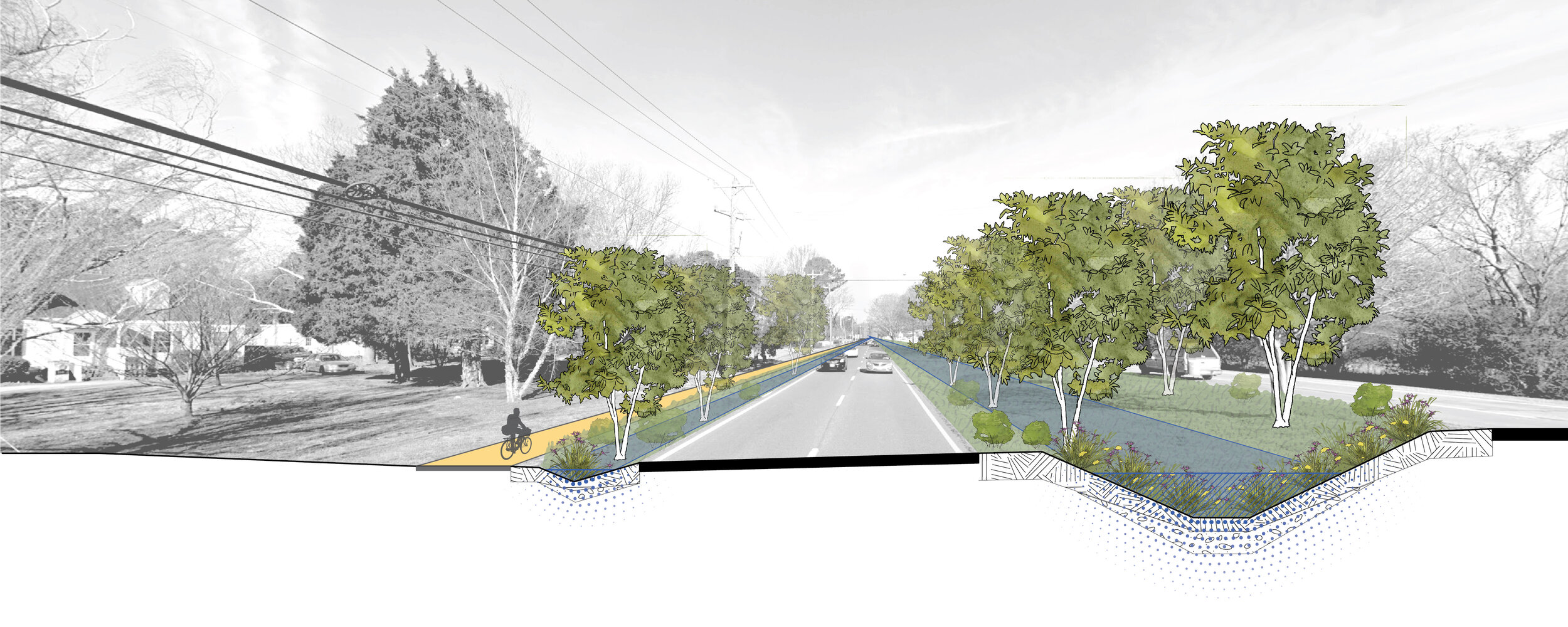

Last week, the $12 million Environmental Impact Bond (EIB) we’ve been designing with the Chesapeake Bay Foundation and the City of Hampton officially closed. By issuing the bond, the City matched financial innovation to the creativity found in its nature-based projects: a drainage ditch turned into a bioswale with native plants; a holding pond revamped for stormwater and water quality; a major transportation corridor elevated and protected against flooding.

This creativity is driven partly by necessity. Water management challenges come from all directions in Hampton: climate change-driven precipitation; proliferating impervious surfaces; a creek that winds through the city and swells with the tides; rapid land subsidence; and the highest rate of relative sea level rise on the Atlantic Coast. There’s a lot at stake in this historic city. It’s one of the oldest in the United States – by some counts, the oldest. It’s the home of Joint Base Langley-Eustis, a major military installation and local economic driver that’s highly exposed to climate change risk. Not every coastal city, and not every small city, responds to its challenges the way Hampton did: with bold action that envisions its citizens “living with water” in a transformed resilient cityscape.

We modify each EIB to fit the issuer and their environmental challenges. Hampton wanted to signal – both to prospective investors and its citizens – its seriousness in doing resiliency right. We worked with the City’s Departments of Community Development, Public Works, and their Resiliency Officer to design the EIB outcome metric: gallons of stormwater storage capacity added. This metric represents improved resilience to chronic and extreme flooding, and quantifying project performance lets the City make smarter decisions about the rest of its resiliency project pipeline.

With the help of the City’s bond counsel (Kutak Rock), financial advisor (Davenport & Co.), and underwriter (Morgan Stanley), the Hampton EIB’s Official Statement reflects the “enhanced impact measurement” that sets the EIB apart from its regular municipal- and green-bond cousins: the prediction, evaluation, and disclosure of actual post-implementation impacts achieved by the projects. Nonetheless, we made sure to align the EIB with the ICMA Green Bond Principles and the United Nations Sustainable Development Goals.

It’s important to make clear that although the EIB checked the boxes to be considered a green bond, we purposely went a step further. A green bond must declare an intent for its funding to be used for green projects, but doesn’t have to report back on actual achieved environmental outcomes once the projects are complete. The Hampton EIB pushes the envelope on ESG bonds by declaring an intent to fund green projects, and then also describing its methods for post-implementation impact measurement and disclosure to investors. This enhances the bond’s appeal to a spectrum of mainstream, green bond, and ESG-oriented investors.

When the EIB went from the drafting table to the selling floor, the response was tremendous. The City attracted its usual mainstream municipal bond investors based on its excellent credit rating. But, the enhanced impact measurement of this relatively small bond drew the eye of some of the largest ESG-oriented bond investors in the world. The increased investor demand led to the bond being well oversubscribed – with the majority bought by ESG funds – putting downward pressure on the City’s interest costs.

Each EIB moves the massive municipal bond market toward greater transparency and accountability in ESG investments. Hot on the heels of Hampton is Buffalo, NY, which will fund parcel-scale green infrastructure for private homeowners. Stay tuned for that one, and for future news on an EIB in Memphis, TN.